RWE records strong financial performance in the first three quarters of 2025 and continues to invest in growth

12.11.2025

RWE continued to forge ahead with its ‘Growing Green’ investment and growth strategy in 2023: the company's portfolio is growing continuously and sustainably. In the past year, RWE invested a total of €11.4 billion net, compared to €4.4 billion in 2022. The acquisition of Con Edison Clean Energy Businesses in the US accounted for the largest share of capital expenditure at €6.3 billion. Further funds were invested in new wind and solar power facilities and battery storage systems in Europe and the US, supplemented by acquisitions in the Netherlands and the UK. As a result, the company’s portfolio grew by more than 160 facilities with a total capacity of 6.3 gigawatts (GW). At the same time, RWE reduced the CO2 emissions of its power plant portfolio by 27% in fiscal 2023 – from 83 million metric tons in 2022 to 60.6 million metric tons in the year under review. RWE’s electricity production from renewables increased by 27% to 45.2 terawatt hours (TWh) in 2023 compared to 35.5 TWh in the same period the previous year.

Markus Krebber, CEO of RWE AG: “RWE looks back on a successful fiscal 2023. We achieved very good earnings, significantly expanded our green portfolio and at the same time substantially reduced our CO2 emissions. The fact that RWE is becoming increasingly climate-friendly while remaining a reliable energy company is not least thanks to our employees, whom I would like to thank for their outstanding performance last year. We are resolutely pursuing our ‘Growing Green’ strategy: another 100 projects with a total capacity of more than 8 gigawatts are already under construction.”

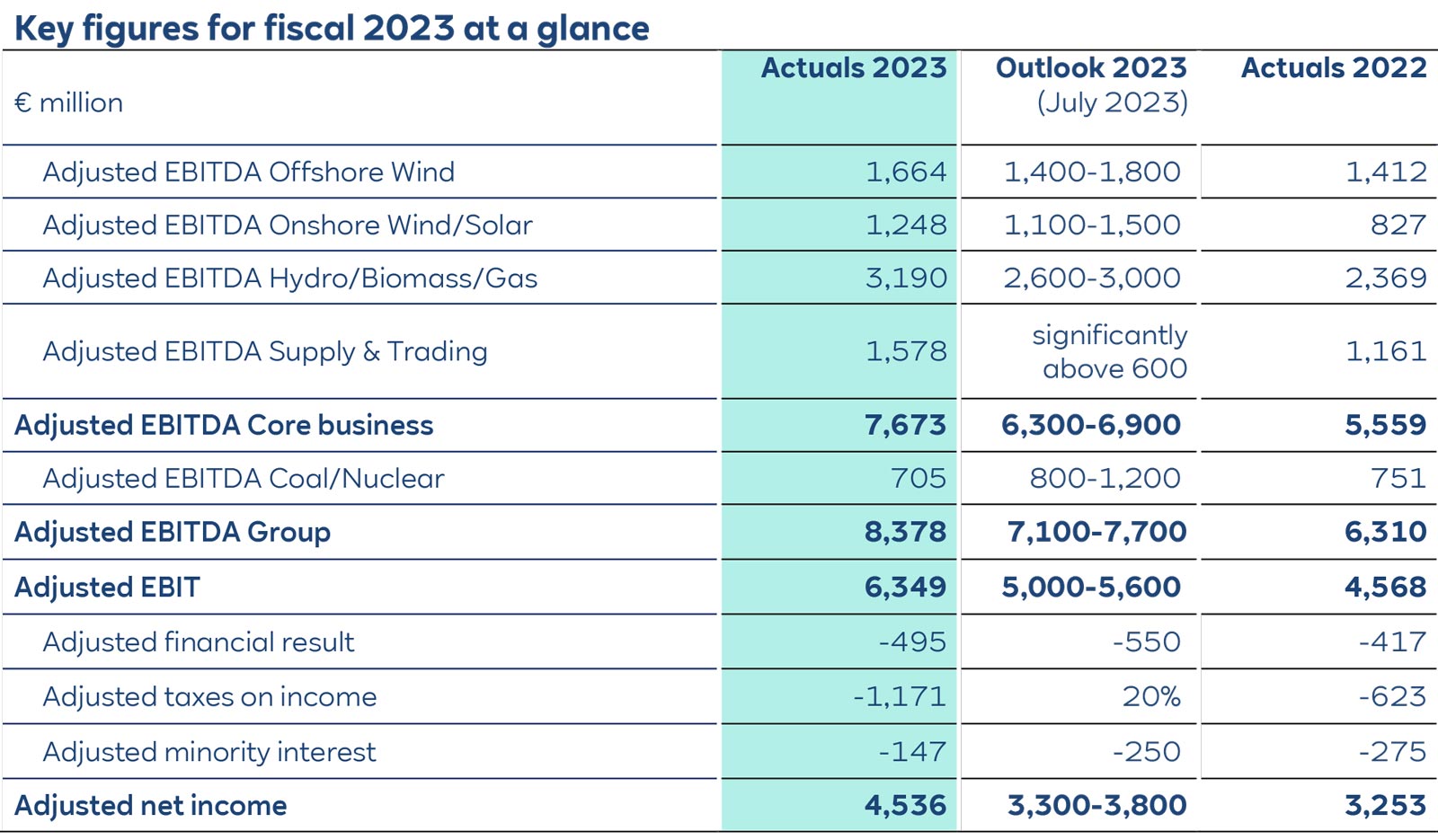

Business performance 2023

The RWE Group’s adjusted EBITDA (adjusted earnings before interest, taxes, depreciation and amortisation) for fiscal 2023 amounted to €8.4 billion, and thus exceeded the forecast range. At €7.7 billion, adjusted EBITDA from the core business also surpassed the outlook. This was mainly due to higher earnings from international electricity generation and the strong trading performance. Another key driver of earnings growth was the capacity expansion in renewables. Adjusted net income, at €4.5 billion, also exceeded the outlook. In contrast to developments in the RWE Group’s international core business, its coal and nuclear business contributed less to earnings than in the previous year. RWE confirms its dividend target of €1.00 per share for fiscal 2023.

Offshore Wind: Adjusted EBITDA in the Offshore Wind segment amounted to €1.7 billion in fiscal 2023, compared to the prior-year figure of €1.4 billion. The increase in earnings is due to the commissioning of new capacity. More favourable wind conditions also had an impact, especially at RWE’s UK sites.

Onshore Wind/Solar: The Onshore Wind/Solar segment recorded adjusted EBITDA of €1.2 billion in fiscal 2023 compared to €0.8 billion in fiscal 2022. This was primarily due to the earnings contribution from the business activities acquired as a result of the takeover of Con Edison Clean Energy Businesses in the US that were fully consolidated as of 1 March 2023, as well as the commissioning of new wind farms, solar parks and batteries. Lower realised power prices had a counteracting effect.

Hydro/Biomass/Gas: Adjusted EBITDA increased in fiscal 2023 to €3.2 billion, compared to €2.4 billion in the prior-year period. This is largely attributable to higher earnings from the commercial optimisation of our power station dispatch in the international generation portfolio and higher generation margins.

Supply & Trading: Due to a strong trading performance across almost all commodities and regions, adjusted EBITDA in fiscal 2023 increased to €1.6 billion, compared to €1.2 billion the previous year. Fiscal 2022 was negatively impacted by a one-off effect: sanctions on coal supplies from Russia led to an impairment of €748 million.

Phaseout business with coal and nuclear energy declining: RWE’s Coal and Nuclear business is the only segment which closed below its prior-year level. Adjusted EBITDA declined to €705 million, compared to €751 million in 2022. This was below the forecast range. The decrease in earnings is a result of lower realised power prices. In addition, the Emsland nuclear power plant only contributed to earnings until it was shut down on 15 April 2023.

Solid financial position despite massive investments

In 2023, RWE invested €11.4 billion, more than doubling its capital expenditure (capital expenditure in 2022: €4.4 billion). The leverage factor, which reflects the ratio of net debt to adjusted EBITDA of the core business, remained well below the self-imposed upper limit of 3.0 at the end of 2023. As at 31 December 2023, RWE had net debt of €6.6 billion and an equity ratio of 31%, which is 10 percentage points higher than at the end of 2022.

Click on the image to zoom

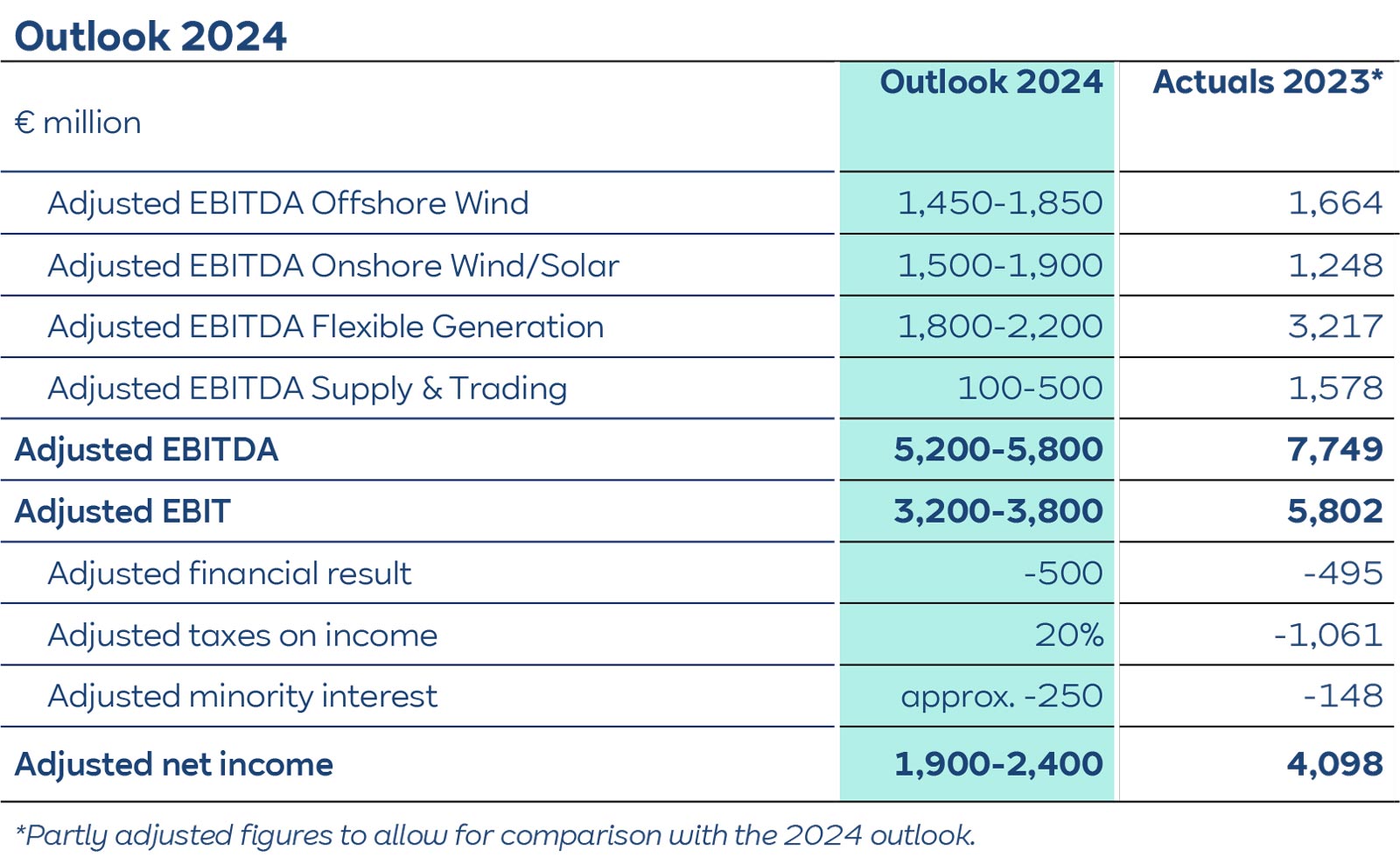

Outlook 2024

In the current fiscal year, RWE expects that it will not be able to match the very good earnings achieved in 2023. RWE communicated its guidance at a Capital Markets Day last November. It envisages adjusted EBITDA within a range of €5.2 billion to €5.8 billion. This guidance remains unchanged despite the significant drop in power prices since then. However, the company currently expects a figure at the lower end of the range. The same applies to adjusted net income of the core business, which RWE anticipates will amount to between €1.9 billion and €2.4 billion. The dividend for the current fiscal year is expected to be raised to €1.10 per share. Details on the earnings forecast for the individual segments can be found in the Annual Report 2023.

Michael Müller, CFO of RWE AG: “We confirm today the outlook for fiscal 2024 that we communicated at our Capital Markets Day. Due to the recent significant drop in power prices on the European wholesale markets, we expect a figure at the lower end of the forecast range. We stick to the planned increase in our dividend: this is set to rise to €1.10 per share for fiscal 2024.”

Click on the image to zoom

Commentary on reporting

From fiscal 2024 onwards, the Hydro/Biomass/Gas segment will be renamed ‘Flexible Generation’; it includes the activities from ‘Hydro/Biomass/Gas' and the 30% stake in EPZ. The Coal/Nuclear segment, in which the lignite business and the nuclear decommissioning activities are pooled, has been renamed ‘Phaseout Technologies’. RWE manages these based on adjusted cash flows. Coal and Nuclear are no longer included in adjusted EBITDA, adjusted EBIT and adjusted net income.